40 how to calculate coupon rate from yield

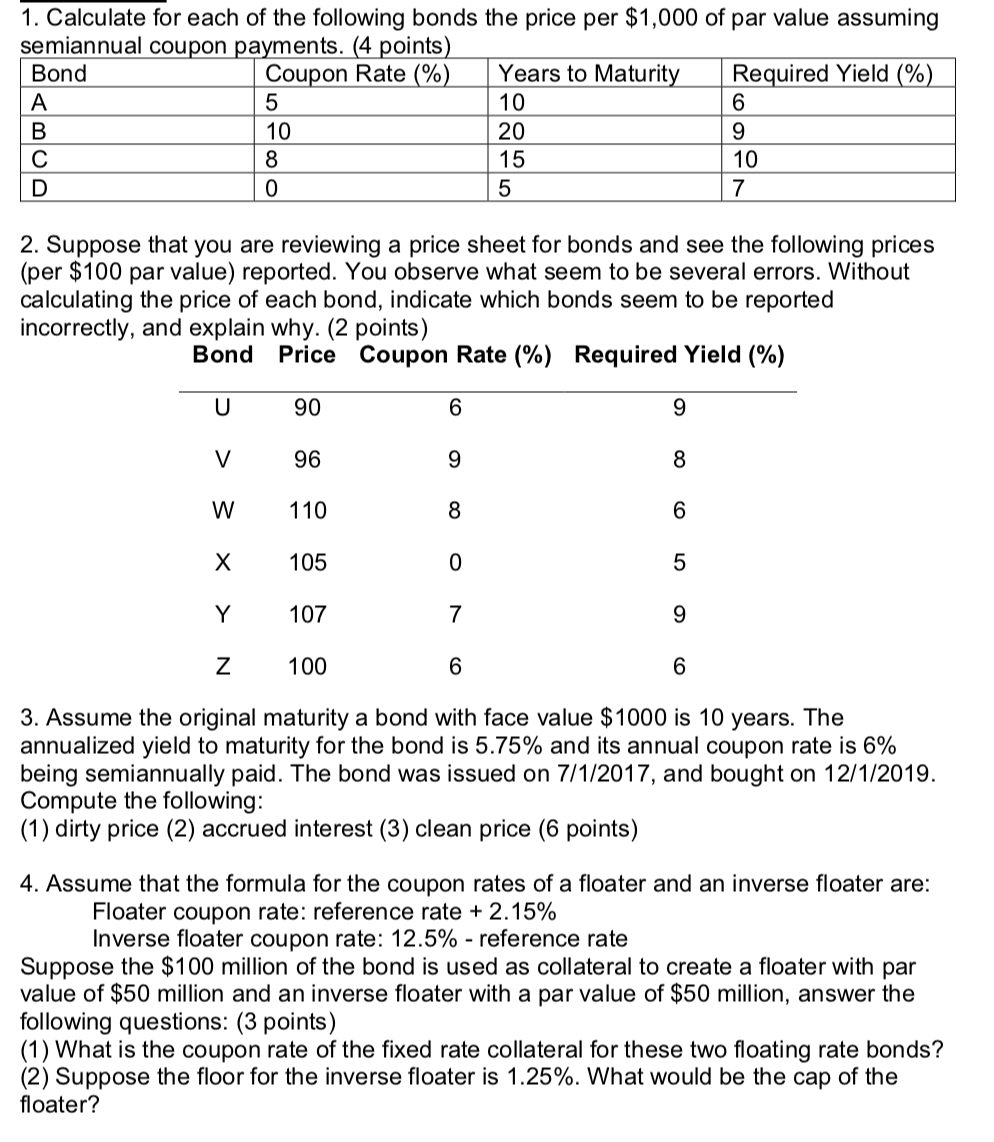

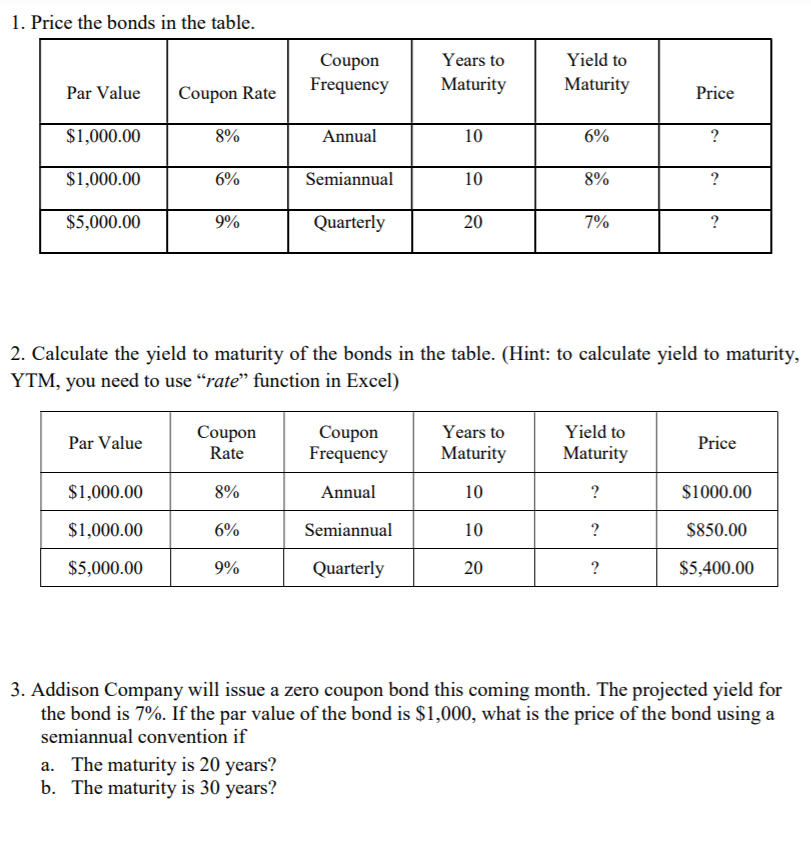

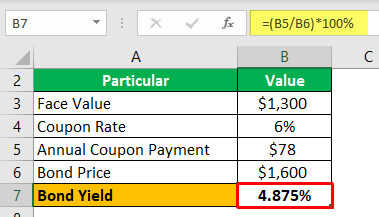

Understanding Coupon Rate and Yield to Maturity of Bonds 3/9/2024. The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes. The frequency of payment depends on the type of fixed income security. In the above example, a Retail Treasury Bond (RTB) pays coupons quarterly. To translate this to quarterly payment, first, multiply the Coupon Rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Bond Yield Formula | Step by Step Calculation & Examples - WallStreetMojo Annual Coupon Payment = Face Value * Coupon Rate =$1300*6% Annual Coupon Payment =$78 Step 2: Calculation of bond yield Bond Yield = Annual Coupon Payment/Bond Price =$78/$1600 Bond Yield will be - =0.04875 we have considered in percentages by multiplying with 100's =0.048*100 Bond Yield =4.875%

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a 6% annual interest rate. 20. Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P ...

How to calculate coupon rate from yield

› personal-finance › how-toHow to Calculate Your Mortgage Payment, Interest, and Principal Aug 12, 2022 · The most common terms for a fixed-rate mortgage are 30 years and 15 years. To get the number of monthly payments you're expected to make, multiply the number of years by 12 (number of months in a ... Coupon Rate and Yield to Maturity | How to Calculate Coupon Rate The coupon rate represents the actual amount of interest earned by the bondholder annually while the yield to maturity is the estimated total rate of return ... Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Therefore, if the 5-Year Treasury Yield becomes 4%, still the coupon rate will remain 5%, and if the 5-Year Treasury Yield increases to 12% yet, the coupon rate will remain 10%. Coupon Rate Vs. Yield to Maturity. Many people get confused between coupon rate and yield to maturity. In reality, both are very different measures of returns.

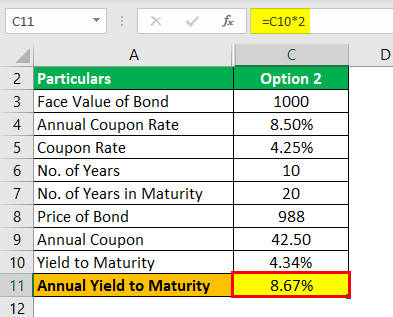

How to calculate coupon rate from yield. Coupon Rate - Meaning, Calculation and Importance - Scripbox Yield to Maturity (YTM) = { (C) + [ (FV - PV) ÷ t]} ÷ [ (FV + PV) ÷ 2] Where, C - Coupon Payment FV - Face value of the bond PV - Current price of the bond t - no. of years to maturity YTM aims to calculate a bond's yield based on its current market price. Coupon Rate - Explained - The Business Professor, LLC What is a Coupon Rate? A coupon rate refers to the annual interest amount that a bondholder receives usually based on the bonds face value. A coupon rate is the bond interest an issuer pays to a bondholder on its issue date. Any change in the value of the bond changes the yield, a situation that gives yield to maturity of the bond. › Calculate-a-Coupon-PaymentHow to Calculate a Coupon Payment: 7 Steps (with Pictures) Aug 02, 2020 · Use the current yield to calculate the annual coupon payment. This only works if your broker provided you with the current yield of the bond. To calculate the payment based on the current yield, just multiply the current yield times the amount that you paid for the bond (note, that might not be the same as the bond's face value). finance - How to calculate internal rate of return (IRR) and yield to ... How do I calculate internal rate of return (IRR) and yield to maturity (YTM) in Sympy? I am trying to calculate the YTM of a bond of $1000 face value that pays $50 in coupons every year. The bond is currently selling for $900, and matures in 3 years. Using the formula for the YTM:

How to Calculate the Tax-Equivalent Yield - The Balance Tax-equivalent yield = interest rate ÷ (1 - your tax rate) Let's assume you're in the 24% tax bracket in this example, and you're looking at a municipal bond that has a coupon, or interest rate, of 2.5%. You would perform the following calculation if you want to know the real rate of return on a nontaxable municipal bond—the rate that ... Current Yield: Formula and Calculator - Wall Street Prep The calculation of the current yield is a straightforward 3-step process: Step 1 → First, the current market price of the bond can be readily observed - in which the bond can either trade at a discount, at par, or a premium to par. Step 2 → Next, the annual coupon must be calculated, which is a function of the bond's coupon rate, par ... Coupon Rate Formula | Simple-Accounting.org A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value.As a simple example, consider a zero coupon bond with a face, or par, value of $1200, and a maturity of one year. How to Calculate Bond Price in Excel (4 Simple Ways) Method 1: Using Coupon Bond Price Formula to Calculate Bond Price. Users can calculate the bond price using the Present Value Method (PV). In the method, users find the present value of all the future probable cash flows. Present Value calculation includes Coupon Payments and face value amount at maturity. The typical Coupon Bond Price formula is

Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond's par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates, etc, Please provide us with an attribution link Coupon Payment Calculator You can quickly calculate the coupon payment for each payment period using the coupon payment formula: Coupon payment = face value * (annual coupon rate / number of payments per year) = $1,000 * (10% / 2) = $1,000 * 5% = $50 Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia A bond's yield, or coupon rate, is computed by dividing its coupon payment by its face value. An updated yield rate can be computed by dividing its coupon by the current market price of the bond. Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator Online coupon rate calculation. Use this simple finance coupon rate calculator to calculate coupon rate.

› ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for ...

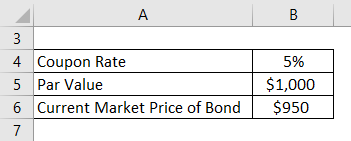

Current Yield Formula | Calculator (Examples with Excel Template) - EDUCBA Current Yield of a Bond can be calculated using the formula given below Current Yield = Annual Coupon Payment / Current Market Price of Bond For Bond 1 Current Yield = $70 / $920 Current Yield = 7.61% For Bond 2 Current Yield = $80 / $1000 Current Yield = 7.27%

What Is Coupon Rate and How Do You Calculate It? - Accounting Services For instance, a bond with a $1,000 face value and a 5% coupon rate is going to pay $50 in interest, even if the bond price climbs to $2,000, or conversely drops to $500. Current yield compares the coupon rate to the current market price of the bond. Therefore, if a $1,000 bond with a 6% coupon rate sells for $1,000, then the current yield is ...

What Is a Coupon Rate? How To Calculate Them & What They're Used For Let's take a look at the formula for calculating the coupon rate and how we can apply them. Simple Formula C = I/P Where: C = coupon rate I = annualized interest P = par value The coupon rate is the rate by which the bond issuer pays the bondholder.

ca.indeed.com › how-to-calculate-current-yieldHow to Calculate Current Yield (Formula and Examples) Jan 03, 2022 · Coupon rate = (total annual coupon payment / par value of bond) x 100. Example: A bond with a face value of $200 and a $5 coupon has a coupon rate of 2.5% because ($5 / $200) x 100 = 2.5%. Nominal yield vs. yield to maturity. Nominal yield is another name for the coupon rate. The yield to maturity is the total return you earn if you hold the ...

Coupon Rate: Formula and Bond Calculation - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000

CEY -- Coupon Equivalent Yield -- Definition & Example - InvestingAnswers The coupon equivalent yield is the effective annual interest rate earned on a bond. It is used to understand what the annual return is or would have been on an investment lasing less than one year. The formula for CEY is: (Interest Paid, in Dollars, Between Now and Maturity / Purchase Price) x (365 / Days to Maturity)

smartasset.com › investing › bond-coupon-rateWhat Is Coupon Rate and How Do You Calculate It? - SmartAsset Aug 26, 2022 · To calculate the bond coupon rate we add the total annual payments and then divide that by the bond’s par value: ($50 + $50) = $100; The bond’s coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond’s interest rate.

how to calculate bond yield to maturity in excel? There are a few steps involved in calculating bond yield to maturity in Excel: 1. Enter the bond's price into a cell. 2. Enter the face value of the bond into a cell. 3. Enter the coupon rate of the bond into a cell. 4.

› coupon-rate-formulaCoupon Rate Formula | Calculator (Excel Template) - EDUCBA Below are the steps to calculate the Coupon Rate of a bond: Step 1: In the first step, the amount required to be raised through bonds is decided by the company, then based on the target investors (i.e. retail or institutional or both) and other parameters face value or par value is determined as a result of which, we get to know the number of bonds that will be issued.

How To Calculate Coupon Rate From Yield - bizimkonak.com Coupon Rate: Formula and Bond Yield Calculator [Excel … CODES (3 days ago) Coupon Rate = Annual Coupon / Par Value of Bond. For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = … Visit URL. Category: coupon codes Show All Coupons

Nominal Yield - Overview, How To Calculate, Example It is calculated by dividing the annual interest payments by the face value of the bond. It is also referred to as the coupon rate of a fixed income security. How to Calculate Nominal Yield The calculation of a nominal yield in annual terms is done by adding all the bond payments made during the year.

Coupon Rate Calculator | Bond Coupon The annual coupon payment is the product of the two, as seen in the formula below: annual coupon payment = coupon payment per period * coupon frequency. As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50.

How To Find Coupon Rate Of A Bond On Financial Calculator Once you have this information, you can follow these steps to calculate the coupon rate: 1) Enter the face value of the bond into the calculator. 2) Enter the coupon rate into the calculator. 3) Enter the number of years until the bond matures into the calculator. 4) Enter the market interest rate into the calculator.

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Therefore, if the 5-Year Treasury Yield becomes 4%, still the coupon rate will remain 5%, and if the 5-Year Treasury Yield increases to 12% yet, the coupon rate will remain 10%. Coupon Rate Vs. Yield to Maturity. Many people get confused between coupon rate and yield to maturity. In reality, both are very different measures of returns.

Coupon Rate and Yield to Maturity | How to Calculate Coupon Rate The coupon rate represents the actual amount of interest earned by the bondholder annually while the yield to maturity is the estimated total rate of return ...

› personal-finance › how-toHow to Calculate Your Mortgage Payment, Interest, and Principal Aug 12, 2022 · The most common terms for a fixed-rate mortgage are 30 years and 15 years. To get the number of monthly payments you're expected to make, multiply the number of years by 12 (number of months in a ...

:max_bytes(150000):strip_icc()/Term-Definitions_yieldtomaturity_FINAL-bbbebc60d39345e9b5be26e89e8cb62f.png)

Post a Comment for "40 how to calculate coupon rate from yield"