45 duration zero coupon bond

Bond: Financial Meaning With Examples and How They Are Priced 1.7.2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ... Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months.

Zero-Coupon Bonds: Characteristics and Examples - Wall Street Prep If the zero-coupon bond compounds semi-annually, the number of years until maturity must be multiplied by two to arrive at the total number of compounding periods (t). Formula Price of Bond (PV) = FV / (1 + r) ^ t Where: PV = Present Value FV = Future Value r = Yield-to-Maturity (YTM) t = Number of Compounding Periods

Duration zero coupon bond

How to Calculate Bond Duration - wikiHow Use the following steps to calculate bond duration. Part 1 Gathering Your Variables 1 Find the price of the bond. The first variable you will need is the bond's current market price. This should be available on a brokerage trading platform or on a market news website like the Wall Street Journal or Bloomberg. Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. Solved Given its time to maturity, the duration of a | Chegg.com This problem has been solved! You'll get a detailed solution from a subject matter expert that helps you learn core concepts. See Answer. Given its time to maturity, the duration of a zero-coupon bond is ________. Group of answer choices higher when the discount rate is higher higher when the discount rate is lower lowest when the discount rate ...

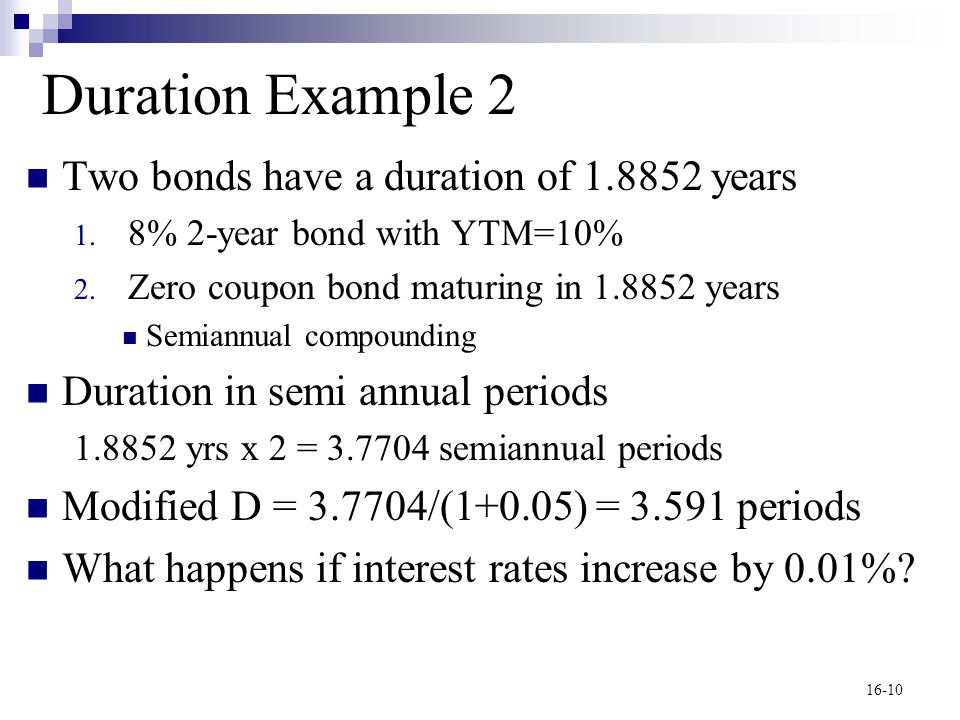

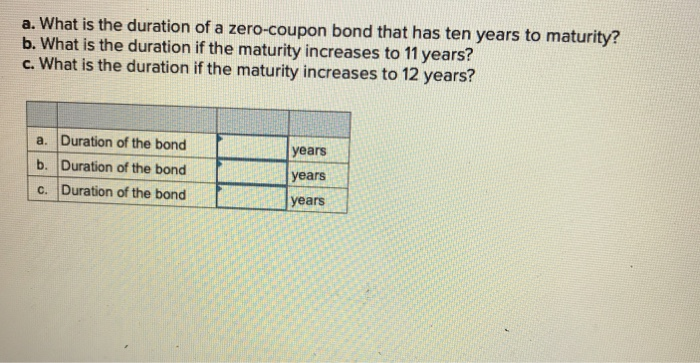

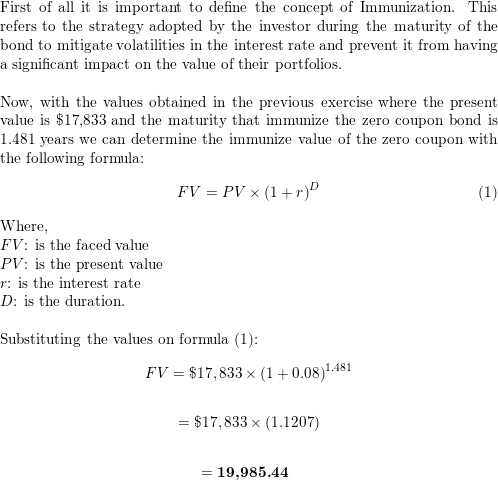

Duration zero coupon bond. What is the duration of a zero-coupon bond that has eight years ... - Quora Answer (1 of 5): Macaulay duration is the weighted average time to cash flow, weighted by the present value of the cash flow. A zero-coupon bond only has one cash flow, so the Macaulay duration is equal to the time to cash flow, 8 years and 10 years in your question. The modified duration is the... Dollar Duration - Overview, Bond Risks, and Formulas What is Dollar Duration? Dollar duration is a bond analysis method that helps an investor ascertain the sensitivity of bond prices to interest rates changes. The method measures the change in the price of a bond for every 100 bps (basis points) of change in interest rates. ... including forwarding contracts, zero-coupon bonds, etc. Therefore ... Duration Of Zero Coupon Bond - bizimkonak.com Zero Coupon Bond Modified Duration Formula - Bionic … CODES (7 days ago) We barely need a calculator to find the modified duration of this 3-year, zero-coupon bond. Its Macaulay duration is 3.0 years such that its modified duration is 2.941 = 3.0/ (1+0.04/2) … Visit URL. Category: coupon codes Show All Coupons Bond duration - Wikipedia For a standard bond, the Macaulay duration will be between 0 and the maturity of the bond. It is equal to the maturity if and only if the bond is a zero-coupon bond. Modified duration, on the other hand, is a mathematical derivative (rate of change) of price and measures the percentage rate of change of price with respect to yield.

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Zeros, as they are sometimes called, are bonds that pay no coupon or interest payment. will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond ... Advantages and Risks of Zero Coupon Treasury Bonds 31.1.2022 · If a zero-coupon bond is purchased for $1,000 and given away as a gift, ... Ext Duration Treasury ETF." PIMCO. "PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund." fixed income - Duration of callable zero coupon bond - Quantitative ... Assume a flat yield curve of 10%. What is the bond duration? A- 10 Years B- 5 Years C- 7.5 Years D- Cannot be determined based on the data given. According to me it should be 10 years as the duration of a zero coupon bond is always equal to its maturity. But I am not getting convinced with my answer because of the callable feature in the question. How to Calculate Yield to Maturity of a Zero-Coupon Bond 10.10.2022 · Duration indicates the years it takes to receive a bond’s true cost, weighing in the present value of all future coupon and principal payments. more Bond: Financial Meaning With Examples and How ...

Zero-Coupon Bonds and Taxes - Investopedia Zero-coupon bonds may also appeal to investors looking to pass on wealth to their heirs. If a bond selling for $2,000 is received as a gift, it only uses $2,000 of the yearly gift tax... Duration: Understanding the Relationship Between Bond Prices and ... In the case of a zero-coupon bond, the bond's remaining time to its maturity date is equal to its duration. When a coupon is added to the bond, however, the bond's duration number will always be less than the maturity date. The larger the coupon, the shorter the duration number becomes. Generally, bonds with long maturities and low coupons have ... Zero Coupon Bond Calculator - Calculator Academy 5.1.2022 · where ZCBV is the zero-coupon bond value; F is the face value of the bond; r is the yield/rate; t is the time to maturity; Zero Coupon Bond Definition. A zero-coupon bond is a security that does not pay interest but trades at a discount and renders a profit at maturity when the bond is redeemed for its face value. Zero Coupon Bond Example Duration Definition and Its Use in Fixed Income Investing 1.9.2022 · Duration is a measure of the sensitivity of the price -- the value of principal -- of a fixed-income investment to a change in interest rates. Duration is expressed as a number of years. Bond ...

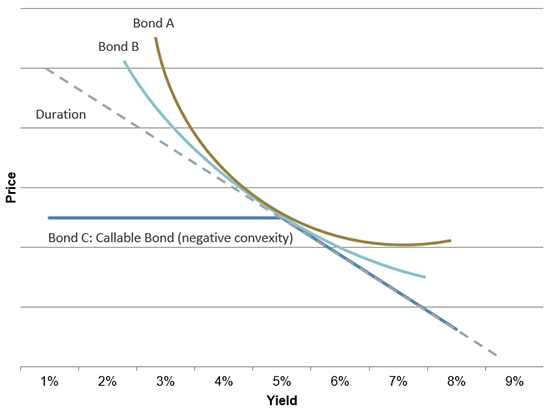

PDF Understanding Duration - BlackRock rates, duration allows for the effective comparison of bonds with different maturities and coupon rates. For example, a 5-year zero coupon bond may be more sensitive to interest rate changes than a 7-year bond with a 6% coupon. By comparing the bonds' durations, you may be able to anticipate the degree of

Zero-coupon bond - Wikipedia Zero coupon bonds have a duration equal to the bond's time to maturity, which makes them sensitive to any changes in the interest rates. Investment banks or dealers may separate coupons from the principal of coupon bonds, which is known as the residue, so that different investors may receive the principal and each of the coupon payments.

The Macaulay Duration of a Zero-Coupon Bond in Excel - Investopedia Calculating the Macauley Duration in Excel Assume you hold a two-year zero-coupon bond with a par value of $10,000, a yield of 5%, and you want to calculate the duration in Excel. In...

duration of zero coupon bonds | Forum | Bionic Turtle The Macaulay duration of a zero-coupon bond equals its maturity, such that the Mac duration of a zero-coupon bond must be monotonically increasing, and. DV01 = Price * Mod duration /10000, where in the case of a zero coupon bond: Price is a decreasing function of maturity (i.e., a zero is acutely "pulled to par"), but Mod duration is an ...

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding

What is the duration of a zero coupon bond? - Quora What is the duration of a zero coupon bond? - Quora Answer (1 of 12): Everyone is telling you that duration is a weighted average of time until you get the cash flows. That is a bad way to think about duration. It is a measure of risk. The Macaulay Duration of a zero is the time to maturity. The Modified Duration is a better measure.

What are Zero-Coupon Bonds? (Definition, Formula, Example, Advantages ... Mr. Tee is looking to purchase a zero-coupon bond with a face value of $50 and 5 years till maturity. The interest rate on the bond is 2% and will be compounded semi-annually. ... Therefore, it might be profitable for the bondholder in the case of a long duration (a higher 'N'). Disadvantages of Zero-Coupon Bonds.

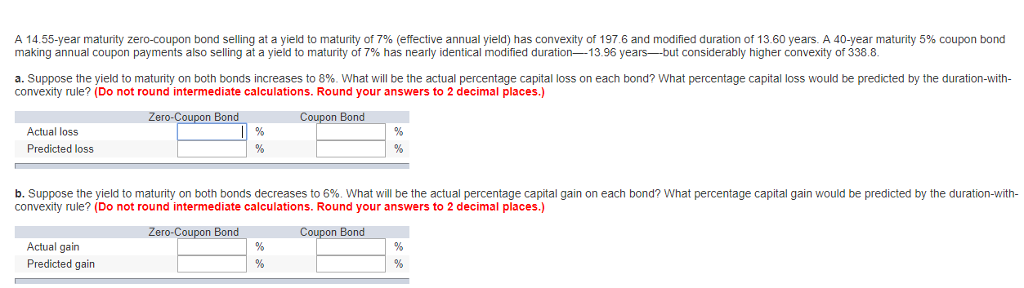

Convexity of a Bond | Formula | Duration | Calculation - WallStreetMojo The number of coupon flows (cash flows) change the duration and hence the convexity of the bond. The duration of a zero bond is equal to its time to maturity, but as there still exists a convex relationship between its price and yield, zero-coupon bonds have the highest convexity and its prices most sensitive to changes in yield.

Zero Coupon Bond Calculator – What is the Market Price? - DQYDJ Zero Coupon Bond Calculator Inputs. Bond Face Value/Par Value ($) - The face or par value of the bond – essentially, the value of the bond on its maturity date. Annual Interest Rate (%) - The interest rate paid on the zero coupon bond. Years to Maturity - The numbers of years until the zero coupon bond's maturity date.; Months to Maturity - The numbers of months until bond …

Zero Coupon Bond Modified Duration Formula - Bionic Turtle We barely need a calculator to find the modified duration of this 3-year, zero-coupon bond. Its Macaulay duration is 3.0 years such that its modified duration is 2.941 = 3.0/ (1+0.04/2) under semi-annually compounded yield of 4.0%.

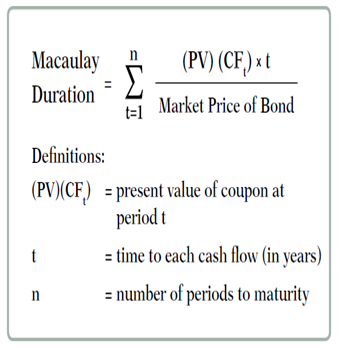

How to Calculate the Bond Duration (example included) Here is a summary of all the components that can be used to calculate Macaulay duration: m = Number of payments per period = 2 YTM = Yield to Maturity = 8% or 0.08 PV = Bond price = 963.7 FV = Bond face value = 1000 C = Coupon rate = 6% or 0.06

Bond Duration Calculator - Macaulay and Modified Duration - DQYDJ From the series, you can see that a zero coupon bond has a duration equal to it's time to maturity - it only pays out at maturity. Example: Compute the Macaulay Duration for a Bond. Let's compute the Macaulay duration for a bond with the following stats: Par Value: $1000; Coupon: 5%; Current Trading Price: $960.27; Yield to Maturity: 6.5% ...

Zero Coupon Bond | Investor.gov The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years. These long-term maturity dates allow an investor to plan for a long-range goal, such as paying for a child's college education. With the deep discount, an investor can put up a small amount of money that can grow over many years.

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Solved Given its time to maturity, the duration of a | Chegg.com This problem has been solved! You'll get a detailed solution from a subject matter expert that helps you learn core concepts. See Answer. Given its time to maturity, the duration of a zero-coupon bond is ________. Group of answer choices higher when the discount rate is higher higher when the discount rate is lower lowest when the discount rate ...

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19.

How to Calculate Bond Duration - wikiHow Use the following steps to calculate bond duration. Part 1 Gathering Your Variables 1 Find the price of the bond. The first variable you will need is the bond's current market price. This should be available on a brokerage trading platform or on a market news website like the Wall Street Journal or Bloomberg.

/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

Post a Comment for "45 duration zero coupon bond"