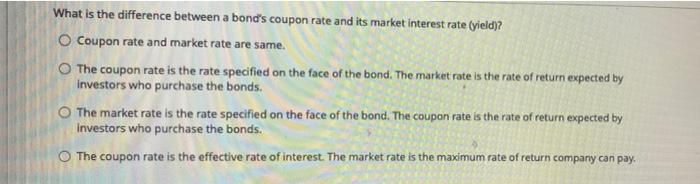

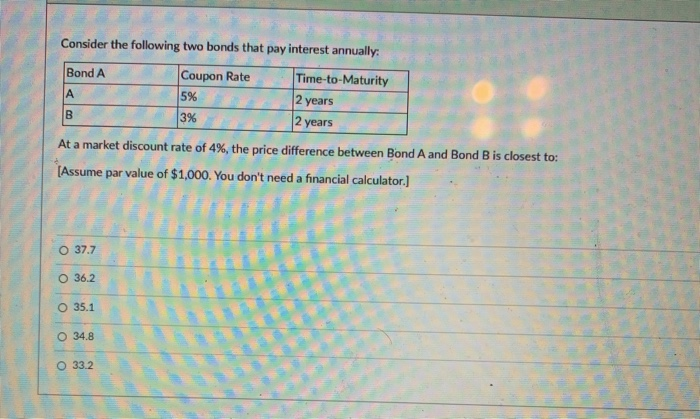

41 difference between coupon rate and market rate

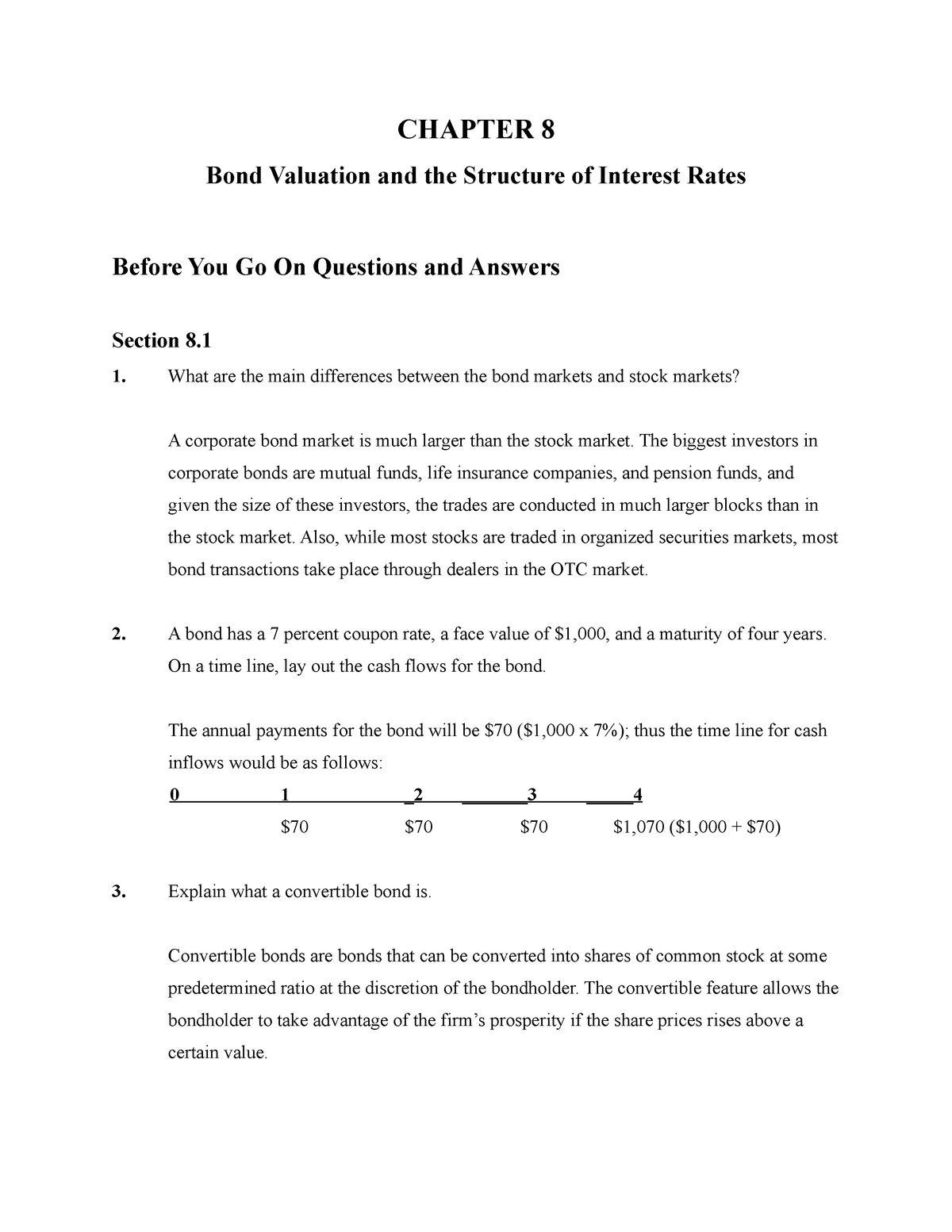

Coupon Rate Definition - Investopedia A bond issuer decides on the coupon rate based on prevalent market interest rates, among others, at the time of the issuance. Market interest rates change ... Coupon Rate vs Interest Rate - WallStreetMojo The coupon rate is decided by the issuer of the bonds to the purchaser. The interest rate is decided by the lender. ... Coupon rates are largely affected by the ...

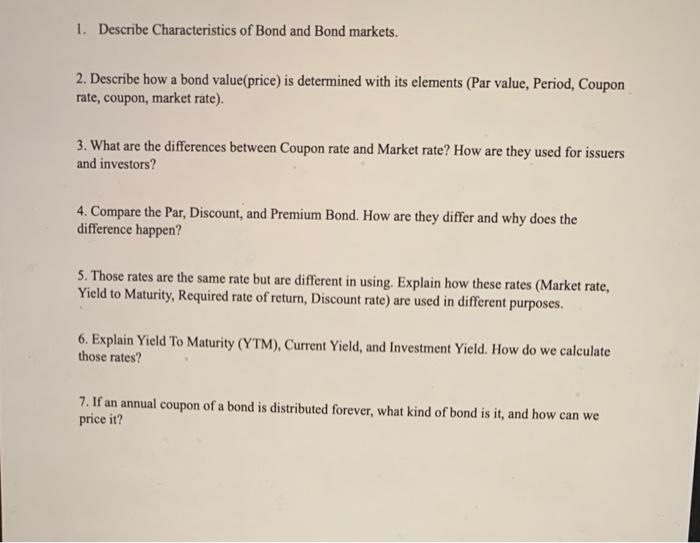

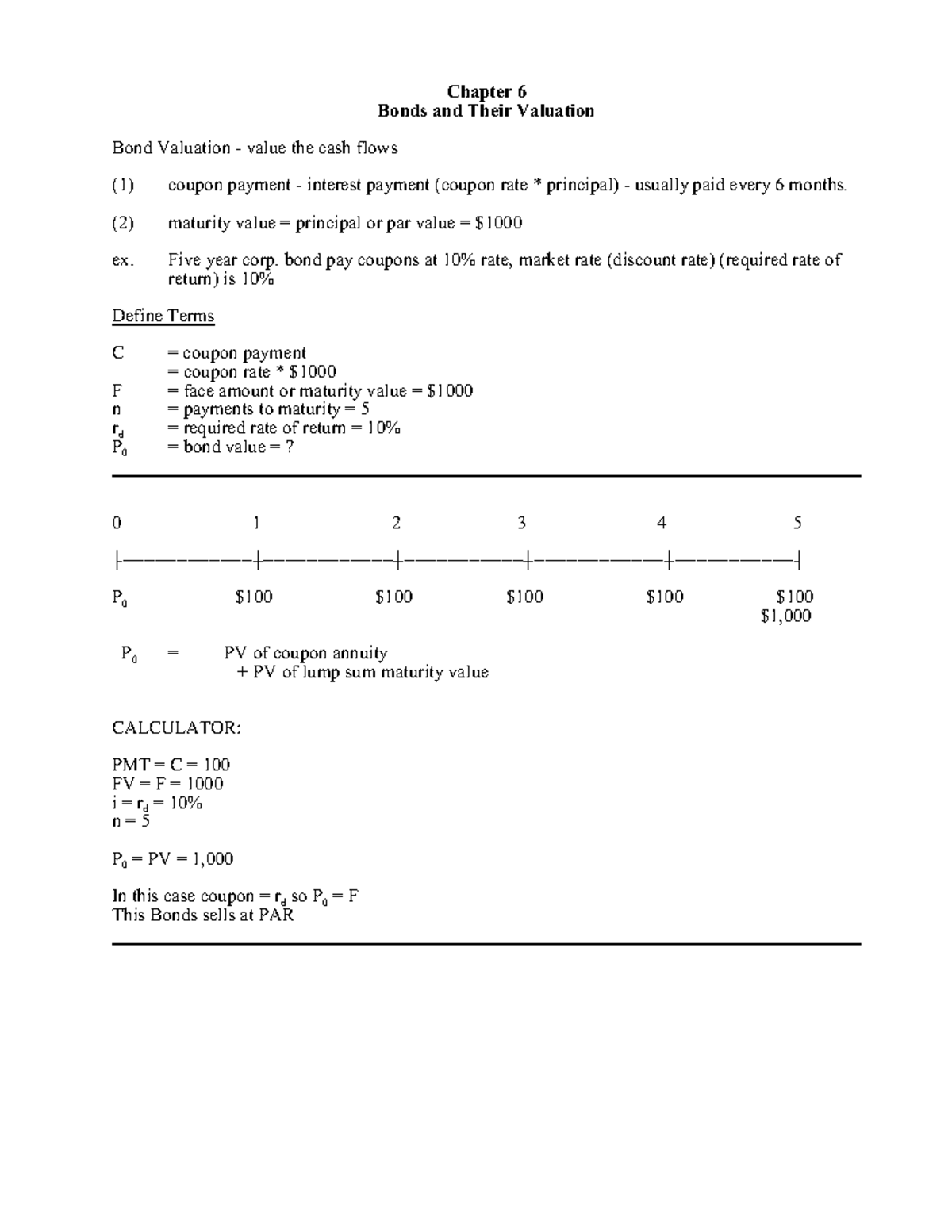

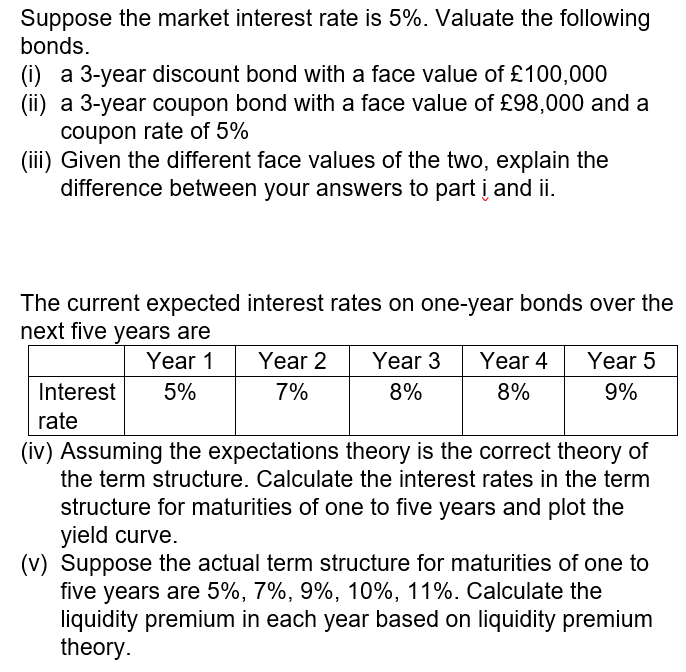

The Difference Between Coupon and Yield to Maturity - The Balance Mar 04, 2021 · Coupon vs. Yield to Maturity . A bond has a variety of features when it's first issued, including the size of the issue, the maturity date, and the initial coupon. For example, the U.S. Treasury might issue a 30-year bond in 2019 that's due in 2049 with a coupon of 2%.

Difference between coupon rate and market rate

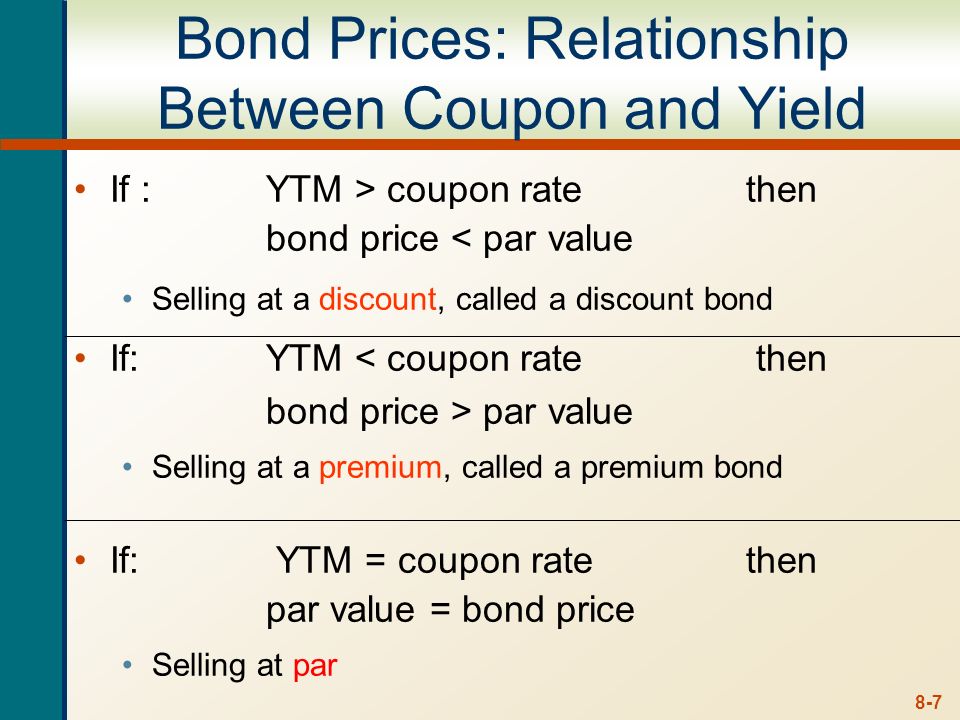

Yield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Interest Rate Risk Between Long-Term and Short-Term Bonds Mar 18, 2022 · Find out the differences and effects of Interest rates between Long-term and short-term bonds. Read how interest rate risk affect and impact these bonds and learn how you could avoid it. Difference between Coupon Rate And Yield To Maturity - Angel One The rate at which a bond makes interest payments to the investor is commonly termed as the coupon rate. It represents the annual interest rate paid out by the ...

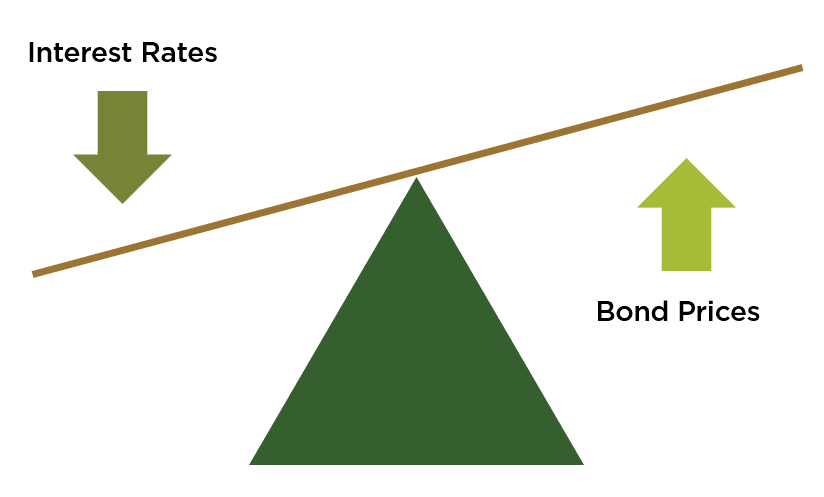

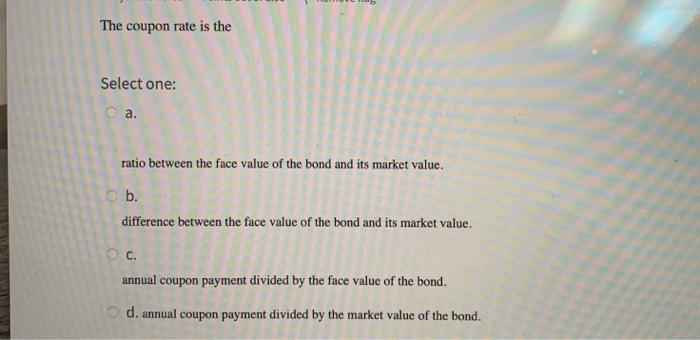

Difference between coupon rate and market rate. Option (finance) - Wikipedia The first part is the intrinsic value, which is defined as the difference between the market value of the underlying, and the strike price of the given option The second part is the time value , which depends on a set of other factors which, through a multi-variable, non-linear interrelationship, reflect the discounted expected value of that ... Bond Stated Interest Rate Vs. Market Rate - PocketSense A coupon rate is a fixed rate of return attached to the face value of the bond paid to the purchaser from the seller, while the market interest rate can change ... Coupon Rate - Definition - The Economic Times The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 bond ... What is the difference between coupon and yield? - IndiaInfoline Coupon refers to the stated interest rate payable each year, while yield refers to the actual return an investor earns from holding a bond for a year.]

Difference Between Coupon Rate And Yield Of Maturity - Nirmal Bang The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year, whereas yield of maturity ... Forward Rate vs. Spot Rate: What's the Difference? - Investopedia Jun 30, 2022 · The restaurant has an immediate business need and must pay the current market price in exchange for the goods to be delivered on time. ... The difference between the spot rate and forward rate is ... What is the difference between coupon rate and market - Course Hero What is the difference between coupon rate and market rate?If a bond sells at its par value or face, you will get your principle back plus the periodic ... Learn How Coupon Rate Affects Bond Pricing Oct 11, 2022 ... The yield-to-maturity only equals the coupon rate when the bond sells at face value. The bond sells at a discount if its market price is below ...

Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · What Is the Difference Between a Bond's Coupon and Yield? ... To compensate for this, the bond will be sold at a discount in secondary market. Although the coupon rate will remain 3%, the lower ... What is the difference between a zero-coupon bond and a ... Aug 31, 2020 · The difference between a regular bond and a zero-coupon bond is the payment of interest, otherwise known as coupons.A regular bond pays interest to bondholders, while a zero-coupon bond does not ... Bond Yield Rate vs. Coupon Rate: What's the Difference? Coupon rates are the yields associated with regular interest payments made by bonds and are influenced by prevailing interest rates. · A bond's yield is the rate ... Difference between Coupon Rate And Yield To Maturity - Angel One The rate at which a bond makes interest payments to the investor is commonly termed as the coupon rate. It represents the annual interest rate paid out by the ...

Interest Rate Risk Between Long-Term and Short-Term Bonds Mar 18, 2022 · Find out the differences and effects of Interest rates between Long-term and short-term bonds. Read how interest rate risk affect and impact these bonds and learn how you could avoid it.

Yield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "41 difference between coupon rate and market rate"