39 what does coupon rate mean

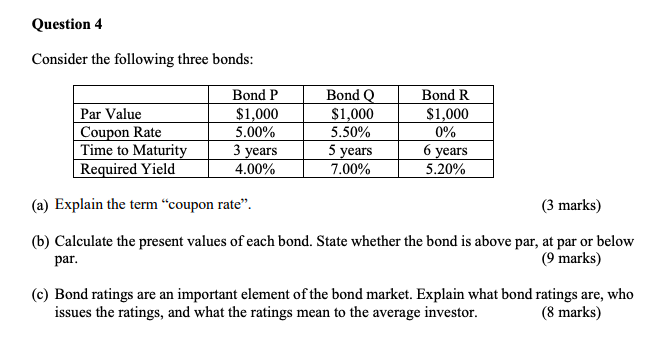

What is a Coupon Rate? - Definition | Meaning | Example Definition: Coupon rate is the stated interest rate on a fixed income security like a bond. In other words, it's the rate of interest that bondholders receive from their investment. It's based on the yield as of the day the bond is issued. What Does Coupon Rate Mean? What Does Coupon Rate Mean In Bonds - bizimkonak.com (9 days ago) Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated … Visit URL Category: coupon codes Show All Coupons What is a Coupon Rate? - Definition Meaning Example CODES

What does Coupon Rate mean? - YouTube Marketing Business Network 13.1K subscribers The coupon rate is the annual interest rate paid on a bond. It is represented as a percentage of the bond's face value. This video provides a...

What does coupon rate mean

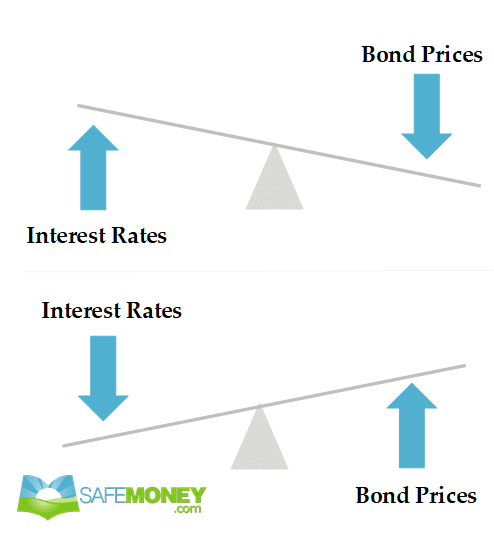

Important Differences Between Coupon and Yield to Maturity - The Balance Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate. Tell me about coupon frequency re: CDs - Ars Technica Posted: Fri Dec 09, 2011 7:12 pm. For a $1000 CD, at anything less than a 5yr term, the difference will be pennies. I'm not sure what the coupon frequency thing is, but the compounding frequency ... Coupon Rate vs Interest Rate | Top 8 Best Differences ... - WallStreetMojo What is Coupon Rate? The coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more is the rate of interest being paid off for the fixed income security such as bonds.

What does coupon rate mean. Coupon-rate Definitions | What does coupon-rate mean? | Best 1 ... Meanings The coupon rate is the rate of interest that is payable on a bond yearly. This rate is determined at the time the bond is purchased and generally does not change. Basically, the higher the coupon rate, the higher the interest payments received from the bond. 0 0 Advertisement What is coupon rate | Definition and Meaning | Capital.com A coupon rate is a yield that is paid out for a fixed-income security such as a government and corporate bond. A coupon rate for a fixed-income security represents an annual coupon payment that the issuer pays according to the bond's par or face value. Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields ... What is the Coupon Rate? - Realonomics The coupon rate or yield is the amount that investors can expect to receive in income as they hold the bond. Coupon rates are fixed when the government or company issues the bond. The coupon rate is the yearly amount of interest that will be paid based on the face or par value of the security.

Coupon Frequency Definition | Law Insider Coupon Frequency definition Open Split View Coupon Frequency means how regularly an issuer pays the coupon to holder. Bonds pay interest monthly, quarterly, semi - annually or annually. (d) Maturity date is a date in the future on which the investor 's principal will be repaid. From that date, the security ceases to exist. Sample 1 Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision The coupon rate is an interest rate that the issuer agrees to pay every year on fixed income security. It is also known as the nominal rate, and it is paid every year till maturity. The method to calculate coupons is fairly straightforward. The coupon is calculated by multiplying the coupon rate by the par value (also known as face value) of ... Coupon Rate Definition & Example | InvestingAnswers In the finance world, the coupon rate is the annual interest paid on the face value of a bond. It is expressed as a percentage. How Does a Coupon Rate Work? The term 'coupon rate' comes from the small detachable coupons attached to bearer bond certificates. The coupons entitled the holder to interest payments from the borrower. What Is Coupon Rate and How Do You Calculate It? - SmartAsset b. The coupon rate is the fixed annual rate at which a guaranteed-income security, typically a bond, pays its holder or owner. It is based on the face value of the bond at the time of issue, otherwise known as the bond's "par value" or principal.Though the coupon rate on bonds and other securities can pay off for investors, you have to know how to calculate and evaluate this important ...

Coupon rate financial definition of Coupon rate - TheFreeDictionary.com The coupon rate is the interest rate that the issuer of a bond or other debt security promises to pay during the term of a loan. For example, a bond that is paying 6% annual interest has a coupon rate of 6%. The term is derived from the practice, now discontinued, of issuing bonds with detachable coupons. What Is a Coupon Rate? - Investment Firms A coupon rate, also known as coupon payment, is the rate of interest paid by bond issuers on a bond's face value. Generally, a coupon rate is calculated by summing up the total number of coupons paid per year and dividing it by its bond face value. So regardless of what goes on with the market, your coupon rate stays the same. Of coupons, yields, rates and spreads: What does it all mean? - YieldStreet The coupon is the annual payment(s) an investor can expect to receive on a bond, expressed as a percent of the par value, which is also known as the principal. Coupon payments are made at regular intervals, usually a year, though for Treasury notes for example, the interval is six months. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

Coupon interest rate financial definition of coupon interest rate coupon interest rate the INTEREST RATE payable on the face value of a BOND. For example, a £100 bond with a 5% coupon rate of interest would generate a nominal return of £5 per year. See EFFECTIVE INTEREST RATE. Collins Dictionary of Economics, 4th ed. © C. Pass, B. Lowes, L. Davies 2005 Want to thank TFD for its existence?

Coupon Definition - Investopedia A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to...

What Does Coupon Rate Mean - bizimkonak.com Listing Websites about What Does Coupon Rate Mean. Filter Type: All $ Off % Off Free Shipping Coupon Rate Definition. CODES (2 days ago) The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity

Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to...

Coupon rate definition — AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond.

What is 'Coupon Rate' - The Economic Times Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value.

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the nominal or stated rate of interest on a fixed income security, like a bond. This is the annual interest rate paid by the bond issuer, based on the bond's face value. These interest payments are usually made semiannually. This article will discuss coupon rates in detail.

What Is a Certificate of Deposit Coupon? | Pocketsense A coupon is the stated rate of interest on the certificate of deposit. The term comes from bonds that have coupons that must be torn off the original bond and redeemed to be paid the interest due. The interest rate specified by the coupon is paid at set intervals. Zero-Coupon Certificates of Deposit

Coupon Rate | Definition | Finance Strategists A coupon rate is the interest attached to a fixed income investment, such as a bond. When bonds are bought by investors, bond issuers are contractually obligated to make periodic interest payments to their bondholders. Interest payments represent the profit made by a bondholder for loaning money to the bond issuer.

Coupon Rate vs Interest Rate | Top 8 Best Differences ... - WallStreetMojo What is Coupon Rate? The coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more is the rate of interest being paid off for the fixed income security such as bonds.

Tell me about coupon frequency re: CDs - Ars Technica Posted: Fri Dec 09, 2011 7:12 pm. For a $1000 CD, at anything less than a 5yr term, the difference will be pennies. I'm not sure what the coupon frequency thing is, but the compounding frequency ...

Important Differences Between Coupon and Yield to Maturity - The Balance Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate.

Post a Comment for "39 what does coupon rate mean"