39 present value of coupon bond

How to calculate the present value of a bond - AccountingTools Go to a present value of $1 table and locate the present value of the bond's face amount. In this case, the present value factor for something payable in five years at a 6% interest rate is 0.7473. Therefore, the present value of the face value of the bond is $74,730, which is calculated as $100,000 multiplied by the 0.7473 present value factor. Calculation of the Value of Bonds (With Formula) Find present value of the bond when par value or face value is Rs. 100, coupon rate is 15%, current market price is Rs. 90/-. ... A Rs. 100/- par value bond carries a coupon rate of 16% interest payable semi-annually and has a maturity period of 10 years. If an investor required rate of return (Discount rate) for this bond is 85 for six months ...

Bond Valuation Definition - Investopedia Bond valuation is a technique for determining the theoretical fair value of a particular bond. Bond valuation includes calculating the present value of the bond's future interest payments, also ...

Present value of coupon bond

Calculating the Present Value of a 9% Bond in an 8% Market The present value of the bond in our example is $36,500 + $67,600 = $104,100. The bond's total present value of $104,100 should approximate the bond's market value. It is reasonable that a bond promising to pay 9% interest will sell for more than its face value when the market is expecting to earn only 8% interest. How to Calculate the Present Value of a Bond | Pocketsense The final period usually coincides with the maturity date. Required Rate (Rate): the interest rate per coupon period demanded by investors. The formula for determining the value of a bond uses each of the four factors, and is expressed as: Bond Present Value = Pmt/ (1+Rate) + Pmt/ (1+Rate) 2 + ... +Pmt/ (1+Rate) Nper + Fv/ (1+Rate) Nper. Bond Formula | How to Calculate a Bond | Examples with Excel Template The term "bond formula" refers to the bond price determination technique that involves computation of present value (PV) ... Let us take the example of another bond issue by SDF Inc. that will pay semi-annual coupons. The bonds have a face value of $1,000 and a coupon rate of 6% with maturity tenure of 10 years. Calculate the price of each ...

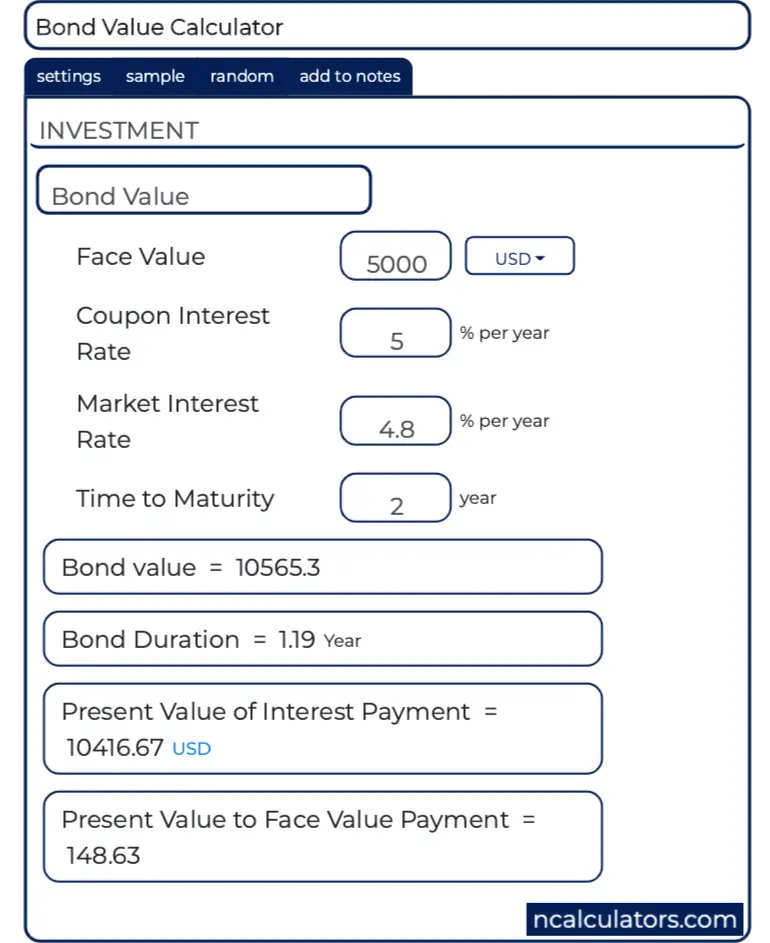

Present value of coupon bond. Corporate Bond Valuation - Overview, How To Value And Calculate Yield To calculate the yield, set the bond's price equal to the promised payments of the bond (coupon payments), divide it by one plus a rate, and solve for the rate. The rate will be the yield. An alternative way to solve a bond's yield is by using the "Rate" function in Excel. Five inputs are needed to use the "Rate" function; time left ... Zero Coupon Bond Calculator - What is the Market Value? So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price or value is the present value of all future cash flows expected from the bond. As the bond has no interest payments, the only cash flow is the face value of the bond received at the maturity date. Zero Coupon Bond Pricing Example. Suppose for example, the business issued 3 year, zero coupon bonds with a face value of ... How to Calculate Present Value of a Bond - Pediaa.Com Step 1: Calculate Present Value of the Interest Payments. Present value of the interest payments can be calculated using following formula where, C = Coupon rate of the bond. F = Face value of the bond. R = Market. t = Number of time periods occurring until the maturity of the bond.

Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. ... As mentioned above, the bond price is the net present value of the cash flow generated by the bond and can be calculated using the bond price equation below: Bond Valuation - Present Value of a Bond, Par Value, Coupon Payments ... OK, well, if the coupon payments are for 10% and then the market interest rates fall from 10% to 8%, then that bond at 10% is valuable, right. It is paying 10% while the overall interest rate is only 8%. Exactly how much is it worth? You mean 'what is the present value of a bond?' How to Calculate the Price of Coupon Bond? - WallStreetMojo Next, determine the present value of the first coupon, second coupon, and so on. Then, determine the present value of the par value of the bond. ... Let us take an example of bonds issued by company ABC Ltd that pays semi-annual coupons. Each bond has a par value of $1,000 with a coupon rate of 8%, and it is to mature in 5 years. The effective ... What is the present value of a 10 year bond that pays | Chegg.com What is the present value of a 10 year bond that pays quarterly coupon, has a coupon rate of 6 percent, a yield to maturity of 8 percent, a par value of $1,000? O $829.79 O $863.22 O $1000.00 O $1,189.87 O $1,287.89.

Bond Valuation Overview (With Formulas and Examples) To find the bond's present value, we add the present value of the coupon payments and the present value of the bond's face value. Value of bond = present value of coupon payments + present value of face value Value of bond = $92.93 + $888.49 Value of bond = $981.42. A natural question one would ask, what does this tell me? Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest. Compound Interest Compound interest is ... Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. How to compute the present value of a bond if the coupons aren't ... But, what if I don't reinvest the coupons? How can I compute the present value? For example: 100 Future value bond, 6% coupon paid semi-anually, the yield its 7%, and it matures in 10 years. The computation would be: FV: 100 Coupon: 100*0.06/2 = $3 Yield: 0.07/2 = 3.5% Periods: 10*2 = 20 Which results in a PV = 92.8938. But this computation ...

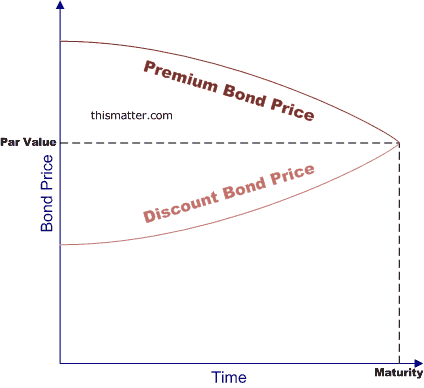

2 The Process Of Bond Valuation Is Based On The Fundamental Concept ... However, for a bond purchased at a premium or a discount to its face value, the yield and the coupon rate are different. Buyers can only get 3% on new bonds, so they are willing to pay extra for your bond, because it pays higher interest. In this example, the price rises to 104, meaning they are willing to pay you $20,800 (20,000 x 1.04).

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. ... Similar to the pricing of other types of bonds, the price of a coupon bond is determined by the present value formula. The formula is: Where: c = Coupon rate.

c) Calculate the Present Value of a zero-coupon bond | Chegg.com Find the duration of the zero-coupon bond. an. Question: c) Calculate the Present Value of a zero-coupon bond with nominal value 1 million pounds and yield to maturity 6% pa and time to maturity equal to 10 years. Find the duration of the zero-coupon bond. an.

BAII Plus Bond Valuation | TVMCalcs.com Adding those together gives us the total present value of the bond. We don't have to value the bond in two steps, however. The TVM keys on the BAII Plus can handle this calculation as we will see in the next example: ... This is one of the key points that you must understand to value a bond between coupon payment dates. Let me recap what we ...

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Instead interest is accrued throughout the bond's term & the bond is sold at a discount to par face value. After a user enters the annual rate of interest, the duration of the bond & the face value of the bond, this calculator figures out the current price associated with a specified face value of a zero-coupon bond.

[Solved] The present value of a coupon bond is: For given change in interest rates, percentage change in present value of bond is classified as; Coupon bonds: Type of bonds that pay coupon interest are classified as; The reason that finding the present value of a future sum of money requires us to discountit, is that: If interest rates rise, the present value of any future earnings is bound ...

Post a Comment for "39 present value of coupon bond"