42 perpetual zero coupon bond

Zero-coupon perpetual bonds? - Rudhar.com The government would issue these bonds specifically for the purposes of allowing the central bank to 'balance' its sovereign money liabilities. The zero-coupon perpetual bonds would not count as part of the national debt as they have no servicing cost (i.e. no interest) for the government, and no repayment obligation. Perpetual Bonds - Overview, Issuers, Advantages, Disadvantages So, for example, assume that you invested in a perpetual bond with a par value of $1,000 by purchasing the bond at a discounted price of $950. You receive a total of $80 per year in coupon payments. Current Yield = [80 / 950] * 100 = 0.0842 * 100 = 8.42% The current yield from the bond is 8.42%. Related Readings

Impossible Finance — The Perpetual Zero Coupon Bond | by ... The formula for calculating the value of a perpetual bond is shown below. D = Coupon per period r = discount rate n = number of periods i.e. infinity This is a very simple calculation for a Zero...

Perpetual zero coupon bond

FWD Group Limited: Zero Coupon USD Perpetuals Indicated at ... To illustrate this in the case of FWD's new zero coupon perpetuals, a 7% p.a. issue yield would imply an issuance price of around 71 cents on the dollar - this compounds back to par over a 5-year period utilising the issue yield of 7% p.a. (compounded on a semi-annual basis). Table 1: Estimated Issue Price for Zero Coupon Bonds (5Y) Our comments All the 21 Types of Bonds | General Features and Valuation ... A zero-coupon bond is a type of bond with no coupon payments. It is not that there is no yield; the zero-coupon bonds are issued at a price lower than the face value (say 950$) and then pay the face value on maturity ($1000). The difference will be the yield for the investor. What is a perpetual bond? Why do companies issue perpetual ... Answer: A perpetual bond is a bond with no maturity date. Companies don't issue them (at least not any more) but they do issue preferred stock, which is a security with a fixed coupon rate and no specific maturity. The big difference is while you are legally required to pay interest on bonds, yo...

Perpetual zero coupon bond. Calling Bitcoin a Ponzi Scheme is Lazy Thinking | by Alvin ... What are zero-coupon perpetual bonds? They are a type of bond that, in theory, combines the features of zero-coupon bonds and perpetual bonds. Zero-coupon bonds: Bonds that do not pay interest but are issued at a discount vs the nominal value of the bond. On maturity, the bond issuer pays back the nominal value of the bond. What are Perpetual Bonds? How to Value Them? - Fervent ... A Perpetual Bond is a fixed income security that pays a series of coupon payments (interest), forever. There is a theoretical possibility of a Perpetual Bond having a Par Value (aka Face Value) like regular bonds / plain vanilla bonds , but this is never paid. So we don't tend to pay any attention to the "par value" for a Perpetual Bond / Consol. investing - Why would zero-coupon perpetuity not be ... Why would a zero-coupon perpetuity not be worth exactly zero? Because its nominal value adds to the stock of debt of the issuer and so it is an option on recovery value - Michael Jezek, Deutsche Bank. This has a bit too much jargon for me to understand clearly, even after multi-tabbing investopedia. Question Types of Bonds - Learn Accounting: Notes, Procedures ... Zero coupon Bonds are also called as Deep discount bonds, the name coming from the fact that these bonds are issued at a heavy discount. Zero coupon bonds are not very common in the retail bond market but have been in place for a long time in the wholesale bond market. Zero coupon bonds are issued at a discount and are redeemed at par on maturity.

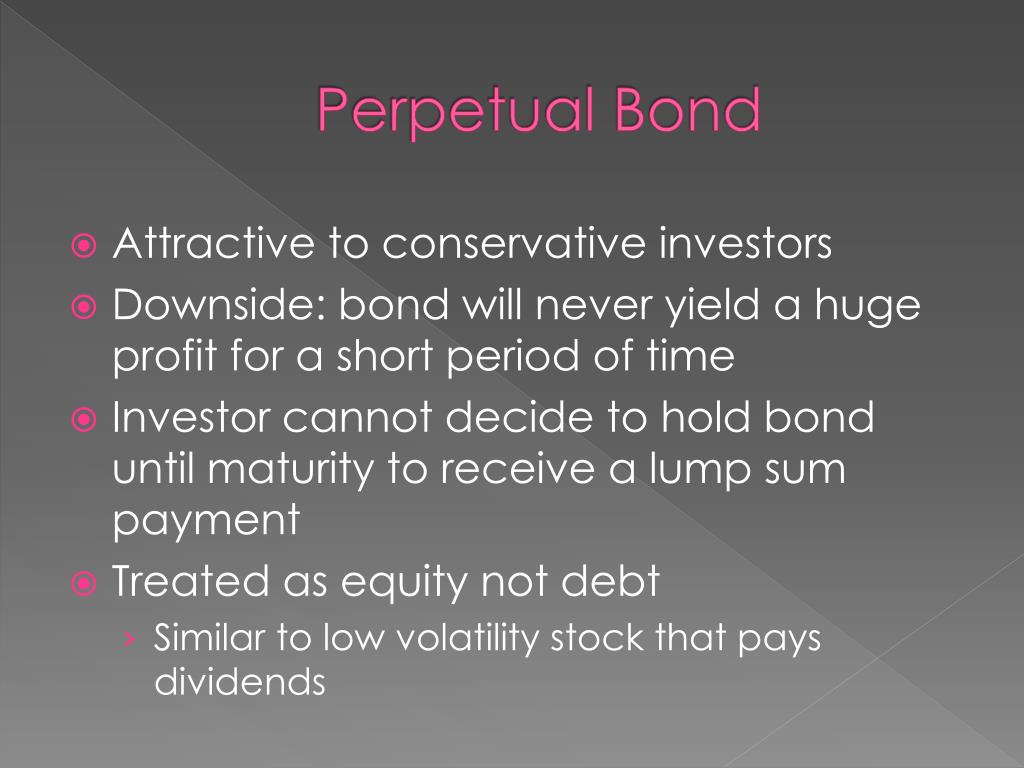

What is the difference between a zero-coupon bond and a ... Zero-coupon bonds may also appeal to investors looking to pass on wealth to their heirs. If a bond selling for $2,000 is received as a gift, it only uses $2,000 of the yearly gift tax exclusion.... economics - perpetual bond that yields 0% - Personal ... They would ask how much would you pay for a perpetual zero coupon bond. The idea is you would pay zero for it since you don't get any coupons, and you never get your money back. Share. Improve this answer. Follow answered Mar 6, 2016 at 13:26. mirage007 mirage007. 371 1 1 ... Perpetual bond - Wikipedia Perpetual bond. A perpetual bond, also known colloquially as a perpetual or perp, is a bond with no maturity date, therefore allowing it to be treated as equity, not as debt. Issuers pay coupons on perpetual bonds forever, and they do not have to redeem the principal. Perpetual bond cash flows are, therefore, those of a perpetuity . PDF BOLI - The "Zero Coupon Perpetual Bond" - NFP Additional features of the BOLI "zero coupon perpetual bond" are: • This bond is often purchased with as much as a 65% discount, without undue credit risk. • The maturity value is essentially guaranteed by the issuer, insurance company, without essentially any default risk. • This is all tax-free per the Internal Revenue Code!

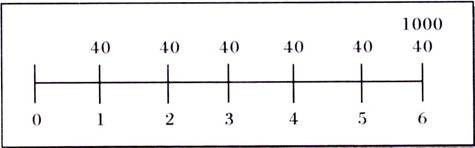

Bond Economics: Seriously, Money Is Not A Zero Coupon ... A perpetual bond is a bond that pays a fixed coupon on a fixed schedule (for example, annually, or semi-annually), but has no fixed maturity date. For example, we could have a perpetual bond that pays $1 on every December 1st (with the standard correction for weekends). These show up a lot in financial and economic theory, but are rare in practice. Zero Coupon Perpetual (NYSEARCA:DXJ) | Seeking Alpha A zero-coupon perpetual bond would be revolutionary. "The hurdle to such extreme helicopter money measures is likely very high since they appear to be at odds with the spirit of Article 5 the... What is the fair price of a perpetual zero-coupon bond ... If the 20 year bond with a maturity value of $100 had a 1 percent per year coupon paying $1 per year in interest and $100 at maturity than the total of payments received on the bond over 20 years would be $120. If the current price of the bond were also $120 than the yield to maturity would be 0 percent. Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is ...

US should issue perpetual zero-coupon bonds - Breakingviews How about issuing a zero-coupon perpetual bond? Such a bond would have several attractions. Since it pays no coupon and never redeems, it would save the Federal government a packet. It would also satisfy the apparent willingness of global investors to snap up low-yield, risky paper.

Chancellor: Zero-coupon bonds are not a joke | Reuters The column teasingly suggested that Washington should issue zero-coupon perpetual bonds, as this would reduce debt service costs. When it appeared in the Breakingviews column of the Wall Street...

PDF Bonds - Wharton Finance » Pure discount or zero-coupon bonds - Pay no coupons prior to maturity. » Coupon bonds - Pay a stated coupon at periodic intervals prior to maturity. » Floating-rate bonds - Pay a variable coupon, reset periodically to a reference rate. zBonds without a balloon payment » Perpetual bonds - Pay a stated coupon at periodic intervals.

Helicopter Money and Zero Coupon Perpentual bonds - PGM ... PERPETUAL ZERO COUPON BONDS: A zero-coupon bond (also discount bond or deep discount bond) is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. The zero-coupon bonds do not make any interest payments (which investment professionals often refer to as the "coupon") until maturity.

Perpetual Bond Definition - investopedia.com Present value = $10,000 / 0.04 = $250,000 Note that the present value of a perpetual bond is highly sensitive to the discount rate assumed since the payment is known as fact. For example, using the...

Chapter 6 Mini Case - Chapter 6 Mini Case(Page 443 Assume that you recently graduated and landed ...

Chancellor: Zero-coupon bonds are not a joke - Breakingviews The column teasingly suggested that Washington should issue zero-coupon perpetual bonds, as this would reduce debt service costs. When it appeared in the Breakingviews column of the Wall Street Journal on April 1, 2006, a couple of irate readers wrote in complaining that a zero-coupon perpetual would have no value.

Zero-Coupon Bond - Definition, How It Works, Formula Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded semi-annually. What price will John pay for the bond today?

Zero Coupon Bond Yield - Formula (with Calculator) The zero coupon bond effective yield formula is used to calculate the periodic return for a zero coupon bond, or sometimes referred to as a discount bond. A zero coupon bond is a bond that does not pay dividends (coupons) per period, but instead is sold at a discount from the face value. For example, an investor purchases one of these bonds at ...

Post a Comment for "42 perpetual zero coupon bond"